|

Gamestop: 'Failing' firm soars in value as amateurs buy stock

In another surprise twist, the unprecedented rally was given a further boost by Elon Musk.

The billionaire Tesla boss tweeted the word "Gamestonk", along with a link to the Reddit message board that had been pumping the stock.

For its part, Reddit said it had not been contacted by the authorities over the stock price movements.

"Reddit's site-wide policies prohibit posting illegal content or soliciting or facilitating illegal transactions. We will review and co-operate with valid law enforcement investigations or actions as needed," a spokeswoman said.

The market turmoil has even come to the attention of new US President Joe Biden, with the White House saying it is "monitoring the situation".

|

|

Google halts Play Store 'review bombing' by GameStop traders

Google has removed a wave of negative reviews of popular stock-market trading apps targeted by furious investors.

Platforms such as Robinhood have been hit after preventing independent traders buying GameStop and AMC shares.

Users of a Reddit message board had managed to upset the market by buying the shares and inflating their value, hitting established hedge funds.

Many online traders, feeling betrayed by Robinhood's restrictions, have hit back with critical reviews of the app.

|

|

The power of the people or the power of Elon Musk?

Redditors restricted from buying GameStop stocks by Robinhood and Trading 212 refocused their efforts on a new venture: Dogecoin. The joke cryptocurrency has been trading at fractions of a cent for most of its existence, but thanks to the stonks gang, it rose from $0.007681 to $0.049 in a day. That’s a 500 percent increase, woof!

The meme cryptocurrency did also get a boost from tech billionaire Elon Musk, who tweeted a picture of ‘Dogue’. It wasn’t the only crypto Musk injected with a little stimulus either: after changing his bio to ‘Bitcoin,’ the currency, which has been trending down since the start of January, surged 20 percent. He later tweeted, ‘In retrospect, it was inevitable.’ Yeah, sure, like he didn’t see that coming

|

|

GameStop: What is it and why is it trending?

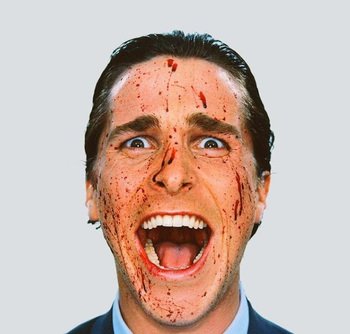

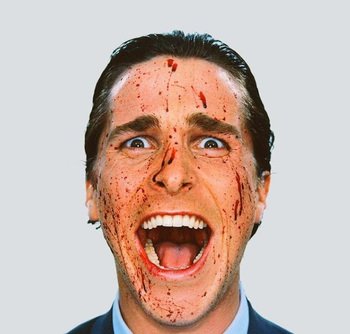

You've probably stared blankly at your WhatsApp chat as the words "GameStop", "Reddit" and "stock market" get thrown around the way "pub" and "meet at 8" used to.

Your friends have become Jordan Belfort from the Wolf of Wall Street overnight, and you have no idea what they're on about.

Well, we see you slyly Googling "What is a GameStop?" and we're here to help.

Everyone loves a story of plucky underdogs and sticking it to "The Man" - and this one is a belter.

First, let's get the basics sorted...

|

Well, unless you were under a few different rocks on Friday, you probably saw this at some point.

|

|

Robinhood, Interactive Brokers restrict trading on GameStop, BlackBerry and other stocks

Online trading platforms Robinhood.com and Interactive Brokers said on Thursday they had restricted trading in shares of GameStop, BlackBerry and other companies that have seen hefty gains this week due to a social media-driven trading frenzy.

Individual investors who trade through online brokerage apps like Robinhood and discuss stocks on anonymous social media messaging boards have driven a dramatic jump in the stock price of companies including GameStop, BlackBerry and AMC Corp.

The outsized gains have forced some hedge funds that had been betting against the stocks to fold their positions and drawn calls for regulatory scrutiny from commentators.

|

|

|

|

|

Google salvaged Robinhood’s one-star rating by deleting nearly 100,000 negative reviews

Unhappy users have been review-bombing the app

|

|

GameStop shares jump 70% Friday as brokerages warn of risky investments

Canadian investing app Wealthsimple is now suggesting limit orders for some volatile stocks

|

|

GameStop: Meet the amateur traders fighting Wall Street

Until the start of the pandemic, it had never occurred to Alex Patton that he could become an amateur trader.

But now, in the wake of the GameStop shares frenzy, he is something of an unlikely veteran of the financial markets.

"Before Covid struck, I didn't know the first thing about investing," says the 28-year-old railway cyber-security engineer, of Kingston upon Thames, south-west London.

But after the stock market took a bad tumble in March last year and dealt his pension savings a blow, he decided that he should, as he puts it, "take a more active role in managing my money".

As a dual national with British and American citizenship, he had no difficulty in setting up an account with US trading platform Robinhood, which has found itself at the centre of the GameStop furore.

|

|

Silver price surges amid investor frenzy — but Reddit users say it isn't them

Feb 01, 2021 2:32 PM

The precious metal rose above $30 US an ounce to highest level since 2013.

The action in silver is partially based on a belief that a run-up in prices would punish Wall Street firms banking on a decline.

"Retail investors are rising up," analyst Phil Flynn with Price Futures Group said. "Refusing to be Wall Street's doormats, retail investors are attacking Wall Street positions that are vulnerable and making them pay. They are banding together and rocking the markets, squeezing stocks like GameStop and AMC and are now turning their attention to silver. They are attacking short sellers, and they are now realizing that silver is undervalued as compared to gold and bitcoin.

|

|

Elon Musk grills Robinhood boss over GameStop row on Clubhouse

Tesla boss Elon Musk has grilled trading app Robinhood's co-founder, Vladimir Tenev, about why it limited users to only being able to buy a small number of shares in some companies.

The move came after US games retailer GameStop's stock surged amid a campaign to cause hedge funds large losses.

Mr Tenev denied “conspiracies” that he was trying to help the hedge funds.

Instead he blamed a demand that Robinhood provide a $3bn (£2.2bn) security deposit at short notice.

The interview was conducted on the audio-only social network Clubhouse.

Mr Musk's 90-minute appearance was a major coup for Clubhouse, which is currently in a "beta" testing phase and requires users to be invited to access its platform.

It allows people to join private rooms for conversations, but participants are capped at 5,000.

However, fans streamed the interview on YouTube and overflow rooms on the platform, as Mr Musk's appearance attracted unprecedented attention.

Mr Musk also spoke about travel to Mars, Bitcoin and brain implants during his session.

|

|

GameStop’s Reddit Revolution Echoes Occupy Wall Street Crusade

An online trading army’s offensive against hedge funds is drawing parallels with the anti-establishment campaign that rattled the financial industry.

|

|

|