|

No such thing. |

|

Debt Jubilee Interview with Dr. David Graeber on the subject of debt jubilee. Graeber is a respected anthropologist who teaches anthropology at Goldsmiths university of London, the author in many leading magazines and of a new book about the history of the last 5000 years of debt. |

|

Debunking nine myths about the deficit. The Roosevelt Institute's New Deal 2.0 blog asked seven economic thinkers to address what they see as the most dangerous myths currently circulating on the deficit. Several of these experts will be on hand to educate the public on April 28, 2010 at George Washington University in Washington, D.C. at a "Fiscal Sustainability Teach-In." In summary:

Myth #1: The government should balance its books like a private household.

Myth #2: Fixing Social Security and Medicare will require "tough choices."

Myth #3: We are passing on debt to our grandchildren.

Myth #4: What we don't tax we have to borrow from the likes of China for our children to pay back.

Reality: Paying our debt holders back consists of transferring funds between accounts.

Myth #5: The government must tax or borrow to get money to spend.

Myth #6: Deficits and government borrowing takes away savings.

Myth #7: We'll end up just like Weimar Germany or Zimbabwe.

Myth #8: Government spending increases interest rates and 'crowds out' valuable private sector investment.

Myth #9: The money spent paying interest on the national debt could be spent elsewhere.

See also: Robert Reich Debunks 6 Big GOP Lies About The Economy

|

|

IMF's epic plan to conjure away debt and dethrone bankers IMF Paper explores state currency and an end to fractionated reserve banking. |

|

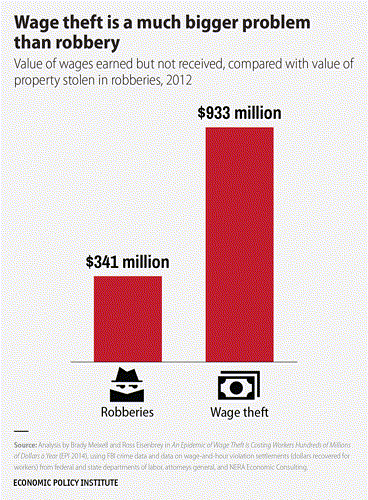

Wage Theft is a Much Bigger Problem Than Other Forms of Theft—But Workers Remain Mostly Unprotected By Brady Meixell and Ross Eisenbrey • September 18, 2014

|